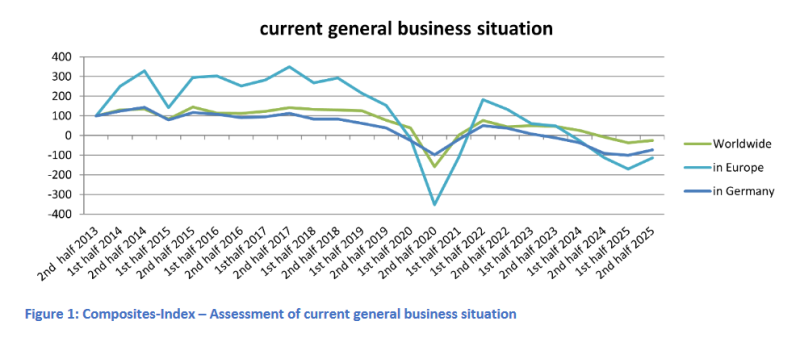

Slight improvement in the assessment of the current business situation

For the first time since the survey in the first half of 2022, the current composites market survey shows a reversal of the trend. (See Fig. 1). The assessment of the current general business situation is turning positive. The assessment of the general business situation remains somewhat more optimistic than that for their own companies, which is also brightening slightly.

It is striking that in the current survey, the assessment of the general market situation for Germany and Europe tends to be more optimistic than for the situation worldwide. This becomes even clearer when assessing one’s own company. Here, positive assessments are evident for Germany and Europe, whereas the global situation is viewed critically. It remains to be seen whether this is a general trend or just a snapshot in an otherwise rather negative market environment. In this context, it should not be overlooked that the positive momentum now emerging is based on a very negative assessment. Nevertheless, a corresponding burgeoning optimism is clearly evident in the figures.

Against the backdrop of a significant decline in market volume for the composites industry in Europe in 2024, strong growth in competitive pressure, particularly from Asia, and a continuing weak global economy and problems in the two key application industries of transport and construction/infrastructure, this positive assessment is somewhat surprising. It appears that the majority of the companies involved have succeeded in consolidating their market position, particularly in Germany and Europe.

The critical assessment of the global situation is likely to be due primarily to the highly volatile, often export-damaging policies in the USA and the continuing tense global political climate. The current weak market situation, especially in the transport sector in Asia, underpins the negative assessments here.

The generally positive assessment of the current situation also seems to be supported by rising expectations for future market development, which are even more positive than the assessment of the current situation.

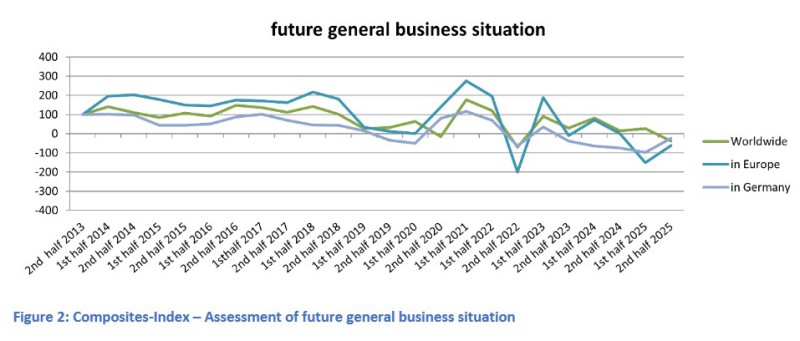

Future expectations show positive trends

The positive effects mentioned above are quite evident in the assumptions regarding future general market development. (See Fig. 2). A positive trend is evident for both Germany and Europe, although the low level of previous surveys should not be overlooked here either. How- ever, companies are generally more optimistic about the future than in previous surveys.

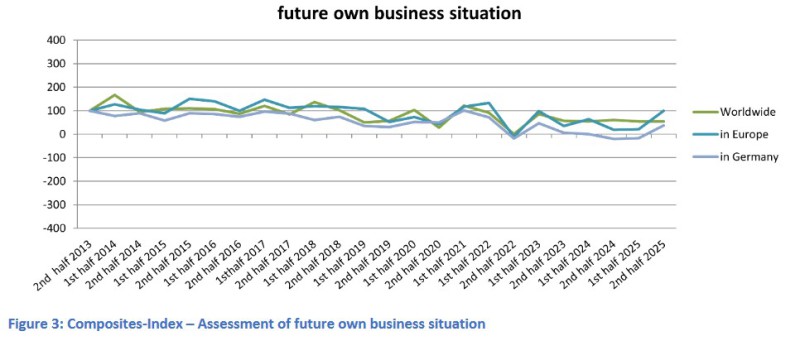

The generally more optimistic assessment is also reflected in expectations regarding the respondents’ own business situation. Almost one-third of respondents anticipate an improvement in their own situation in Europe. only 8 % of respondents expect the situation to deteriorate further. The figures for Germany are slightly lower. Around a quarter of respondents believe that there will be a positive development, while 9 % expect a further deterioration. Worldwide, the proportion of those with positive expectations for the future falls to 20 %. (See Fig. 3).

Investment climate brightens

The current somewhat more optimistic assessment of the economic situation is also having an impact on the investment climate. There are slightly positive shifts in both personnel planning and planned investments in machinery and equipment.

The proportion of respondents who consider machinery investments likely or are planning them has increased from 42 % (survey in the first half of 2025) to 50 %, although the proportion of those who are already planning specific investments has declined slightly. (See Fig. 4). Here, too, there is a generally optimistic trend, albeit with a rather wait-and-see attitude. This underscores the assessment that it remains to be seen whether the current development is a general trend reversal or just a brief burst of optimism.

The picture is similar when it comes to personnel planning. While 19 % of participants in the last survey (Survey 1/2025) expected an increase in personnel capacity, this figure currently stands at 15 %. On the other hand, there has also been a decline in the number of those who consider personnel reductions likely, from 29 % to 27 %.

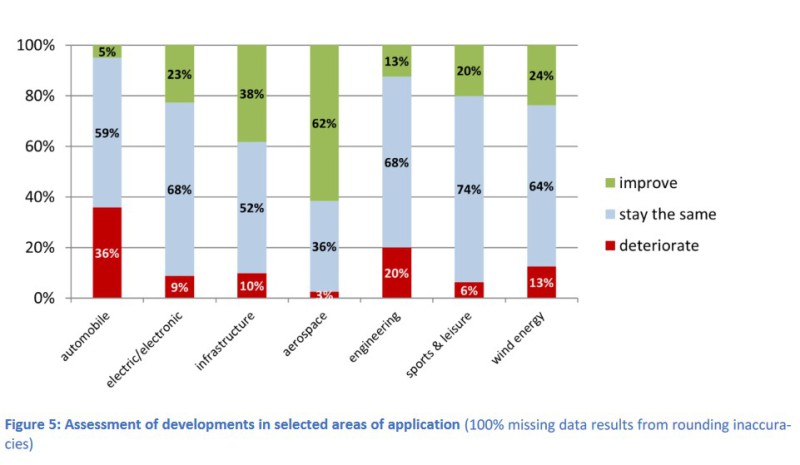

Expectations vary across application industries

The composites market is characterised by a high degree of heterogeneity in terms of both materials and applications. In the survey, participants were asked to give their assessment of market developments in various core areas. The expectations vary greatly. (See Fig. 5). The most important area of application for composites is mobility. This sector is currently undergoing major upheaval and is in a state of crisis in Europe and Germany. This is also clearly reflected in the survey. Growth is expected primarily in the aviation and construction/infrastructure sectors, although the construction sector in Germany continues to face difficulties. Experts currently expect only slight growth for 2025. A significant upturn is not expected until 2026. The picture is similar for Europe.

Growth drivers with slight movements

The current survey shows slight movement in terms of growth drivers. With regard to their assessment of which areas will provide the key growth drivers for the composites industry in the future, CFRP gained slightly. GFRP, on the other hand, as the second strongest material group, declined slightly.

There has been a slight shift at the regional level. The main growth momentum is expected to come from Asia and Europe. North America’s importance as a growth driver is declining significantly, while Germany is gaining ground as a potential growth region.

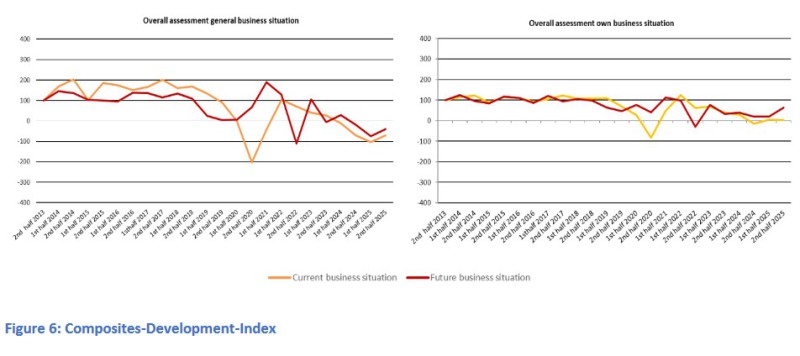

Composites index turns positive

As already indicated in the text, the Composites Index has turned largely positive for the first time since 2022. only the assessment of the current business situation across all regions remains cautious. (See Fig. 6).

It remains to be seen whether it will be possible to build on the current more optimistic mood. Politically, numerous measures are currently being taken to strengthen the German/European economy. However, (financing) ideas and plans must then also be implemented. The construction/infrastructure sector in particular could receive significant impetus from the German growth package. only by working together will it be possible to maintain and further strengthen Germany as a business and industrial location. Due to their special properties, composites as a material group in general continue to offer very good opportunities for expanding their market position in new as well as existing markets. However, they remain dependent on overall eco- nomic developments.

The task now is to open up new market fields through innovation, consistently exploit opportunities and work together to further implement composites in existing markets. This can often be achieved more successfully together than alone. Composites Germany offers a wide range of opportunities with its excellent network.

The next composites market survey will be published in January 2026.

Lu public network security: 37140202000173

Lu public network security: 37140202000173